XM Broker Review

XM

- up to 888:1 Leverage.

- MT4,5 and webtrader

- Deposit Bonus

- Webinars

- Tutorials

- Minimum deposit $5

- Tight spreads

Details

| Broker | XM |

|---|---|

| Website URL | https://www.xm.com/ |

| Founded | 2009 |

| Headquarters | 12 Richard & Verengaria Street, Araouzos Castle Court, 3rd Floor, 3042 Limassol, Cyprus |

| Support Number | +357 25029900 |

| Support Types | telephone , email , chat |

| Languages | Arabic , Chinese , English , French , German , Greek , Indonesian , Italian , Japanese , Korean , Portuguese , Russian , Spanish , Turkish , Hungarian , Polish , Swedish , Malay , Thai , Vietnamese |

| Trading Platform | MT4, MT5, XM Webtrader |

| Minimum 1st Deposit | $5 |

| Minimum Trade Amount | 0.01 |

| Maximum Trade Amount | 100 Lots |

| Leverage | 888:1 “*This leverage does not apply to all the entities of XM group.” |

| Spread | From 0 Pips |

| Free Demo Account | Open Demo |

| Regulated |

|

| Regulation | ASIC, CySEC, IFSC |

| Commissions |

|

| Commission Info | yes |

| Account Types | Micro , Standard , XM Zero Accounts |

| Deposit Methods | Credit Card , Neteller , Skrill , Webmoney , Western Union , Bank wire transfer |

| Withdrawal Methods | Credit Card , Neteller , Skrill , Webmoney , Western Union , Bank wire transfer |

| Trading Methods | Forex Trading , Stocks CFDs , Commodities CFDs , Equity Indices CFDs , Precious Metals CFDs and Energies CFDs |

| Trading Currency | EUR , USD , GBP , JPY , CHF , HUF , PLN , RUB , SGD , ZAR |

| Account Currency | EUR , USD , GBP , JPY , CHF , HUF , PLN , RUB , SGD , ZAR |

| US Traders Allowed | |

| Overall Score | 3 |

Pros

- up to 888:1 Leverage.

- MT4,5 and webtrader

- Deposit Bonus

- Webinars

- Tutorials

- Minimum deposit $5

- Tight spreads

Cons

- Clients registered under the EU regulated entity of the Group are not eligible for the bonus

Table of Contents:

- Brief Overview of XM

- What Is XM Broker?

- Forex Trading XM Account Types

- Insights into XM’s Reliability

- Trading Platforms at XM

- XM Broker Educational Basis

- A Comprehensive Review of XM

- Takeaway

- FAQs

XM Broker is a People’s-choice! Online trading is an art; XM Group is a reputable forex trading and CFD platform established by Trading Point of Financial Instruments Ltd in 2009. There has been a sea-change in the brokerage industry over the years.

It offers advanced technology and services for beginners and experienced traders worldwide. With over 2 million clients, this broker has become one of the world’s largest forex brokers.

There is no denying the importance of foreign exchange brokers; having a trusted forex broker is crucial to the success of the forex trading business in the global market of today.

This analysis reviews XM Broker’s pros and cons, providing traders with valuable insights for understanding the market and choosing a reliable forex broker.

Let’s have a look in-depth XM Review analysis.

Brief Overview of XM

Trading is always changing, especially forex trading, which is essential to success globally. XM Broker is a go-to choice for beginners and experienced traders in the foreign exchange market.

Through Trading Point of Financial Instruments Ltd., XM Group is a licensed brokerage founded in 2009. XM Broker has been regulated since 2009 by CySEC 120/10 and ASIC 443670. Its user-friendly platforms and customer-centric approach make it a popular trading platform for individuals and corporate clients.

Key Features of the Broker

Investment Variety: XM Broker trades forex, stocks, commodities, indices, energies, and metals. Traders can access multiple markets from one platform.

Trading Platforms: The Broker provides MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms provide technical analysis, advanced charting, and algorithmic trading.

Account Types: XM Broker offers various trading styles and experience levels, including Micro, Standard, and XM Ultra Low accounts, with varying minimum deposits and spreads.

Leverage and Margin: XM Broker offers leverage options for traders to manage larger positions with less capital, increasing profits and risks.

Educational Support: The broker offers webinars, seminars, video tutorials, and trading articles to help traders learn.

Customer Service: XM Broker provides 24/7 multilingual customer assistance for trading and technical inquiries.

In addition, XM Broker has Islamic accounts for Muslim traders who follow Sharia. Because of this, many investors choose this broker because they appreciate having a partner who is accommodating of their religious beliefs.

If you’re thinking about or before investing, consider the risks.

What Is XM Broker?

When it comes to online brokerage services, traders all over the world turn to XM Broker. XM is the market leader in providing access to international financial markets and for good reason.

XM Broker provides advanced platforms like MetaTrader 4 and MetaTrader 5 for hassle-free trade performance and market analysis tools across various trading instruments like forex, commodities, indices, and cryptocurrencies.

In addition, XM Broker’s transparency, competitive pricing, and excellent customer service make it one of the best options.

Pros

Regulatory Compliance:

XM Broker is regulated by CySEC, ASIC, and IFSC, providing a secure trading environment for traders. This regulatory compliance boosts confidence and ensures the security of funds.

Diverse Account Types:

XM Broker serves to traders’ skill levels and risk control with different account types, from Micro to Zero, offering a customized trading experience based on goals and preferences.

Competitive Spreads:

Trading profits depend on tight spreads. High-volume traders and those on a tighter budget will appreciate XM Broker’s low spreads. Having competitive spreads improves the trading experience and increases the likelihood of making a profit.

Diverse Trading Tools:

XM Broker provides various trading instruments, including forex, stocks, commodities, and indices. This wide range of options lets traders expand their products well, reducing risk and taking benefit of opportunities in different sectors.

Advanced Trading Technology:

MetaTrader 4 and 5—which XM Broker supports—provide modern charting, analysis, and automated trading options. Mobile applications enable convenient trading and account access on the go.

Cons

Limited Educational Resources:

Compared to other brokers, XM’s educational assets may need updating. To better serve the trading industry, they should offer webinars and in-depth training to increase knowledge and skills.

Inactivity Fees:

XM Broker charges inactivity fees, disadvantaging traders who don’t engage in frequent trading. It confuses particular traders from trading, limiting their hopes to profit from market conditions.

Response Times Varies:

XM Broker offers customer service, but response times may vary. That frustrates traders who need immediate help during market moments and may hurt their trading experience.

Withdrawal Times:

The platform’s withdrawal processing times frustrate traders who need funds quickly. Efficiency and waiting time reduction can boost user satisfaction.

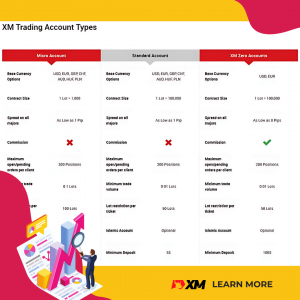

Forex Trading XM Account Types

Choosing a suitable Forex Trading account is crucial for success. To meet traders’ needs, XM Broker offers multiple account types. Let’s look at the Accounts Guidelines that will help you choose wisely:

- Micro Account:

The Micro account is perfect for beginners or traders with smaller trading volumes, offering tight spreads, flexible leverage options, and access to all trading platforms. A minimum deposit of $5 provides a great starting point for learning Forex trading without risking significant capital.

- Standard Account:

The Standard account offers affordability and flexibility for traders, with a minimum deposit of $5 and access to all platforms, tight spreads, and leverage options up to 1:888. It is popular for larger volume trading and competitive trading conditions.

- XM Zero Account:

The XM Zero account is ideal for experienced traders seeking tight spreads and low costs. With a minimum deposit of $100, it offers 0 pips spreads and 1:500 leverage options. It’s an ECN-based account with direct market access, faster performance, and no requotes.

What Other Accounts Does XM Offer?

- XM Demo Account:

XM offers a risk-free Demo Account for new traders to familiarize themselves with its trading platforms and improve their skills. A demo Account is a mirror of real-world market conditions, enabling traders to learn, practice, and develop before real-time trading. It tracks price changes, evaluates strategies, and tests tools, boosting confidence and skill development.

- Shares Account:

The Shares account offers a $10,000 minimum deposit, access to 1,200 global stocks, competitive commissions, and real-time market execution. Also, its premium adjustments, make it ideal for traders expanding investments and trading stocks alongside Forex.

- Islamic Account:

XM Broker has Islamic accounts for people who are Muslim and follow the rules of Shariah principles. It’s swap-free and like Micro, Standard, and Zero accounts, so traders who follow Islamic finance principles can use it.

- Ultra-Low Account:

For those who trade frequently and/or use strategies like “scalping,” the Ultra-Low Account provides attractive pricing and tight spreads. It quickly performs trades to take advantage of even minute price changes.

XM Broker offers various account types of traders, serving beginner-to-experienced needs. If you want to forex trade with confidence, you’ve chosen the strategy that best fits your needs, goals, and level of risk.

Insights into XM’s Reliability

XM Broker is the go-to for dependable solutions that help markets gain in the modern digital era.

It prioritizes reliability, efficiency, and safety in its products. And also, its advanced technology offers services that help traders take part. In addition, provide exceptional customer experiences.

XM Broker is a reliable partner for market rise, focusing on customer-centric satisfaction and regular improvement.

XM’s Deposits and Withdrawals

XM’s deposit and withdrawal processes are pretty good. And every transaction that is over USD 200 is free of charge. Withdrawals take two days at most, and deposits appear within an hour.

XM Broker follows Anti-Money Laundering and “return to source” policies to return withdrawals to the original funding source. To accommodate a wide range of customers worldwide, the client portal supports 11 currencies: EUR, USD, GBP, AUD, CHF, JPY, RUB, HUF, PLN, ZAR, and SGD.

XM charges currency conversion fees for deposits and withdrawals under USD 200. Credit card deposits and withdrawals are swift, processing time within an hour and two days, ensuring industry standards.

Regardless, the platform prioritizes transparency by covering transfer fees and avoiding hidden costs or commissions on deposits and withdrawals. Also, charged fees on wire transfers under 200 USD or currency equivalent.

XM’s withdrawal process is user-friendly, requiring account login, selecting the preferred method, and entering the desired amount. This makes trading easier for traders.

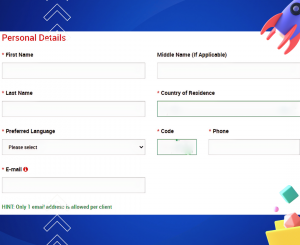

After account verification by customer service, traders can deposit funds through the use of the client portal:

How to Withdraw

- Account holders must “Sign-in”.

- Select Option “Withdraw Funds.”

- Choose an option for the withdrawal method.

- To withdraw, press Enter.

Credit card deposits are processed within an hour; withdrawals take two days. These are typical industry conditions.

See XM’s deposit and withdrawal methods below:

Traders can trust that the platform’s deposit and withdrawal processes are quick, clear, and careful of their needs. Its different payment options reflect XM’s dedication to providing a genuine platform.

Trading Platforms at XM

XM brokers’ MetaTrader 4 and 5 trading platforms provide adaptability, stability, dependability, and advanced charting. Traders like these platforms because they give them advanced tools to drive them to take decisions.

Whatever your trading experience, it will help you choose the right platform. Let’s explore XM’s trading types:

- MetaTrader 4 (MT4):

MT4 integrates with XM, providing advanced charting tools, technical indicators, and real-time market data access. Also, “Expert Advisors” for automated strategies, make it a reliable and essential choice for beginners and experienced traders.

Features of Best MT4 brokers review:

- User-Friendly Interface

- Detailed Charts

- EAs, or Expert Advisors

- Trading with one click

- More than one type of order

- Compatibility with phones

- Tools Used for Technical Analysis

- Data and news in real-time

- Safety and customization

- MetaTrader 5 (MT5):

XM introduces the upgraded MetaTrader 5 platform. It offers an economic calendar, advanced order types, and improved charting for stock, futures, and trading options.

Features of Best MT5 brokers review:

- Extensive Instruments

- In-Depth Charts

- Multiple orders

- Economic calendar

- Better timetables

- Depth of Market (DOM)

- Test Your Plan

- EAs, or Expert Advisors

- Access from mobile devices

- Safety and customization

What Other Trading Platform Does It Offer?

- WebTrader:

XM’s WebTrader allows users to trade through a web browser on any internet-connected device. The platform incorporates up-to-date market data, an intuitive interface, and analytical tools to streamline trading.

Features of Best MT4 brokers review:

- Web-Based Trading

- An easy-to-use interface

- Live Market Statistics

- Trading with a click

- Tools for Technical Analysis

- How to handle risks

- Ease of access

- Language Support

- Protection

- Mobile Trading:

XM Broker’s mobile trading platform allows traders to access accounts, execute trades, and monitor market movements from anywhere, enabling smart market decisions and maximizing opportunities.

Features of Best MT4 brokers review:

- Compatible Mobile Apps

- Live market updates

- Friendly to use

- Trading

- Charting/Technical Analysis

- Taking care of accounts

- Notifications that “push.”

- Safety

- Language Support

XM Broker Educational Basis

Score: 4.5/5

XM provides educational resources for traders of different ability levels, including demo accounts, platform tutorials, videos, and seminars, providing transformative knowledge.

Pros:

- Interactive demo account

- In-depth trading platform tutorials

- Rich library of educational videos

Cons

- None

XM Broker knows how important it is to trade with knowledge, so they offer many ways to learn:

- Demo Account: Experience or try actual trading without risking your funds with a demo account.

- Trading Tutorial: Explore XM’s tutorial videos covering navigation, advanced features, and primary navigation.

- Informative Videos: In-depth videos cover trading strategies, fund management, market analysis, and technical aspects, organized into chapters for user-specific content.

- Insightful Webinars: Live webinars provide market analysis and insights for traders of all skill levels.

While videos are its main educational offering, the broker also allows in-person and remote training. Coordinated learning helps traders understand trading views and strategies, enabling market decisions.

A Comprehensive Review of XM

XM Broker is a trusted brand in the foreign exchange market, offering traders diverse resources and information for all experience levels. Let’s look at broker; that has pros and cons:

Pros

- Several major financial institutions regulate it.

- Many unique financial assets to choose from.

- Competitive trading environments.

- Provides a range of trading accounts, including Islamic ones.

- Trading app and web interface that is simple to use.

- Customer service is available 24/7.

Cons

- Insufficient educational resources.

- Not available to US clients.

- Some accounts have higher minimum deposits.

- Compared to other brokers, it has limited payment methods.

Before making investment decisions, meet as much information as possible by reading an XM Broker review.

Takeaway

XM Broker is dependable, follows regulatory standards, and offers various accounts, competitive spreads, and advanced trading tools. The platform has MetaTrader, WebTrader, and mobile choices to meet the needs of traders.

The platform also offers demo accounts, educational videos, and webinars to help traders access the trading landscape and succeed. XM Review covers many views with pros and cons, allowing traders to achieve their financial goals.

FAQs

Q. Is XM Fake or Real?

Ans: XM is a legitimate, reputable, regulated brokerage with multiple financial authorities.

Q. Is it Safe to Invest?

Ans: Due to its security, transparency, and regulatory compliance, XM is a safe investment.

Q. How Long Is the Withdrawal Time?

Ans: Withdrawals to e-wallets typically take 24 hours, while bank wire transfers can take 2-5 business days.

Q. Can I trade cryptocurrencies?

Ans: Cryptocurrency trading via CFDs is available.

Q. What are the minimum deposits for trading?

Ans: For Micro and Standard accounts, the platform needs $5.

Q. Is XM FCA Regulated?

Ans: The FCA and other bodies are regulated.

Q. Is forex trading secure?

Ans: XM offers risk-free Forex trading with a reputable broker and separate client accounts.

Q. Is Copy Trading Profitable?

Ans. XM copy trading can be profitable if you have a plan and know what you’re doing.

Q. Is it suitable for beginners?

Ans: XM is an excellent beginner forex option with low deposit requirements, educational resources, and demo account features.

Q. Can I trust it to keep my information safe?

Ans: A regulated broker, XM ensure client data protection through advanced encryption and strict policies.

Q. Does it offer customer support in multiple languages?

Ans: Multilingual support from XM Broker helps clients communicate across regions.

Q. Does it provide any educational resources for advanced traders?

Ans: XM provides advanced trader learning through materials, webinars, and seminars.

Visit Broker